“What are some things that we can do with money?”

A sea of little hands shot up in the air. As I called on each highly engaged 1st or 2nd grader, I heard a variety of responses.

“Buy toys. Get things we need like food, water, and shelter. Go to Disney World! Give it to people who need it more than we do. Save it for a rainy day.”

Then, one student confidently dropped some knowledge through his tooth fairy rich smile, “We can invest our money to grow it. The growth compounds over time and builds more wealth.”

In that moment, I was hopeful for the future of America.

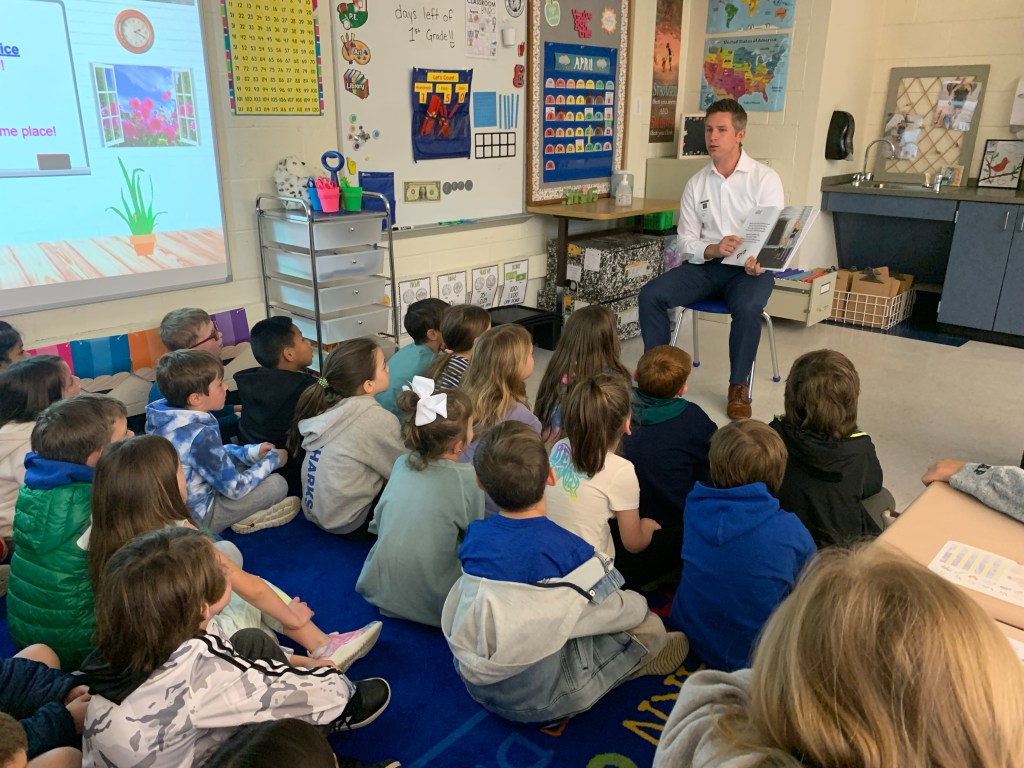

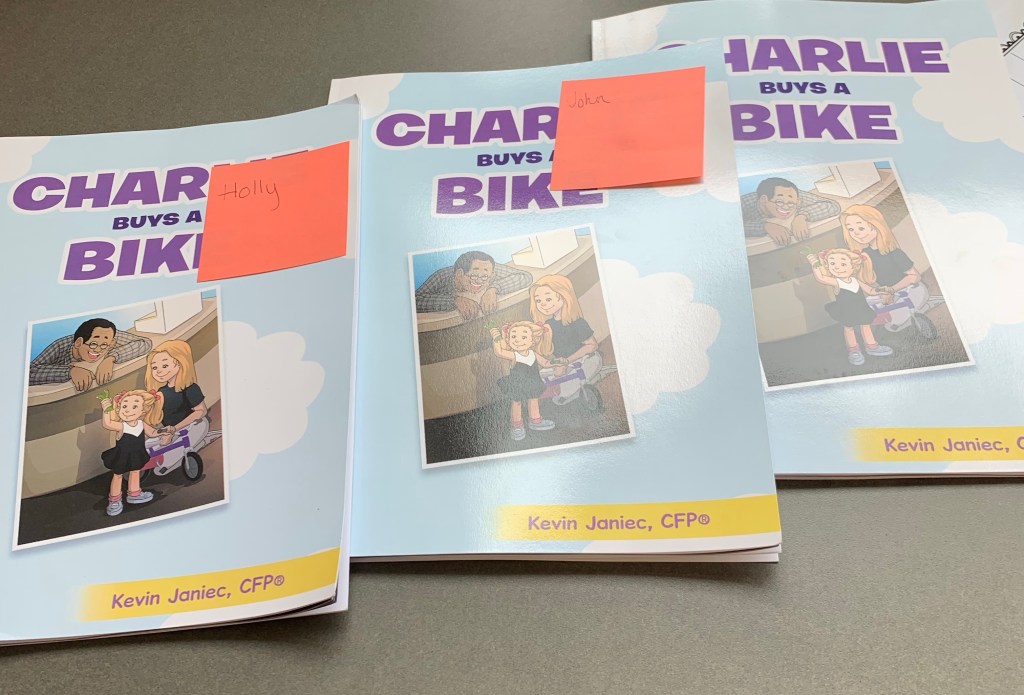

During Financial Literacy Month- otherwise known as April- I went on a Charlie Buys a Bike tour at local schools (including Charlie’s class) to teach kids about saving money. When I first sat down in the tiny plastic chair, I felt a little out of place like Billy Madison. But as I watched the students’ eyes widen with each thoughtful question and insightful answer, I felt a spark being (financially) lit.

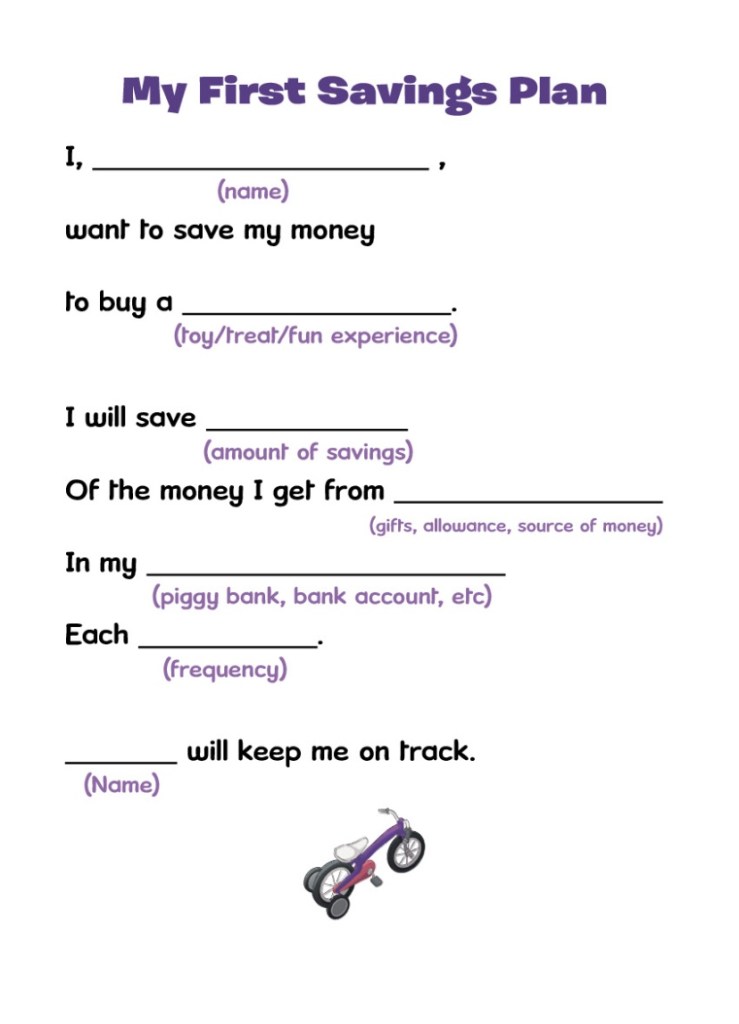

During each visit to Chesterbrook Academy, Westtown-Thornbury, and Rose Tree Elementary, we would take a few minutes to discuss various ways to give, save, and spend money. We talked about why saving is important and how to overcome the challenges that get in the way of our plan. The kids shared different ways they earn money around the house and accumulate cash in their own piggy banks. After a few minutes of conversation, I would read Charlie Buys a Bike to share a fun example of how we can save for the things we love. After the story and a bit of Q&A, I would sign some pre-ordered books while each motivated student created their own savings plan using the activity from the book.

Throughout Chester and Delaware County, there is now a growing population of 6 and 7 year-olds hustling to earn money and proactively saving up for doll houses, video games, bikes, pets, Taylor Swift tickets, and basketball sneakers. I left each session so impressed and I may have offered a few future internships. I have to agree with the 2nd grader from Westtown-Thornbury who told her parents, “Today was awesome. Like sooo good, Mom.”

Going forward, I plan to expand the financial literacy program for 1st-3rd graders at local camps this summer and more schools in the fall. If you are interested in helping your kids or students develop these foundational skills, please let me know. I encourage you to email kevin@thenewealthproject.com and consider sharing this offer with a camp director, elementary school teacher/administrator, or local youth leader.

My takeaway from working with young students in the classroom was similar to my experience working with young parents in the New Wealth Project conference room: Having a clear and intentional savings plan can be powerful – no matter the age or stage.

After all, there’s nothing cooler than hearing a first grader say, “I want to save up to buy a pair of running shoes, so I can start going on jogs with Mommy.”

THAT is “Financially Lit.”